WESTMINSTER, Colo. and NEW YORK, March 30, 2021 /PRNewswire/ -- Today, international environment consultancy Eunomia, with support from Ball Corporation (NYSE: BLL), released a new research report entitled "The 50 States of Recycling: A State-by-State Assessment of Containers and Packaging Recycling Rates" (www.Ball.com/RealCircularity), offering the first state-by-state comparison of recycling rates for the most commonly used containers and packaging materials throughout the United States.

Notable findings include:

- Not all recycling is created equal, and we should prioritize recycling of materials that have the greatest potential to reduce greenhouse gas (GHG) emissions and the highest value for creating new products.

- Collection and recycling are not synonymous, as the quantity of material collected for recycling today is often far greater than what is actually processed and recycled into new products with non-recyclable contaminants making the entire system less effective.

- Recycling policies, such as a Deposit Return System (DRS), or "bottle bill," and investment in infrastructure, such as curbside collection, are crucial to effective recycling systems.

- Overall, the states that have more comprehensive and current recycling data along with a state-driven reporting system achieve higher recycling rates, demonstrating the importance of accurate measurement in moving the U.S. towards a more circular economy.

The first-of-its-kind report is intended to set a baseline in each state that can be leveraged to inform policy, design programs and assess infrastructure proposals and improvements. Using 2018 data sourced from the EPA, states, counties, municipalities, sorting facilities and material processors, the study looked at plastic bottles and trays, glass bottles and jars, aluminum cans, steel cans and cardboard and boxboard. This study takes a bottom-up approach to estimating recycling rates, analyzing what is found in the waste stream based on published state and municipality data to estimate generation and recycling. Importantly, the report focuses on recycling rates based on the actual material reprocessed or "upcycled" into new products, rather than the collection rate, the more commonly used standard of measurement. By taking actual material reprocessed into new products as the point of measurement, the recycling rate is more representative of a material's true circularity and accounts for material losses at the sorting and processing stage.

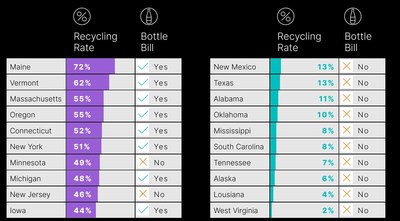

The study found the 10 states with the highest recycling rate for common containers and packaging materials (CCPM) excluding cardboard and boxboard in 2018 are: Maine (72%); Vermont (62%); Massachusetts (55%); Oregon (55%); Connecticut (52%); New York (51%); Minnesota (49%); Michigan (48%); New Jersey (46%); and Iowa (44%).

The 10 states with the lowest recycling rate for CCPM (excluding cardboard and boxboard) in 2018 are: New Mexico (13%); Texas (13%); Alabama (11%); Oklahoma (10%); Mississippi (8%); South Carolina (8%); Tennessee (7%); Alaska (6%); Louisiana (4%); and West Virginia (2%).

"Good data is the foundation of smart policy, and this study shows there is enormous opportunity for improving U.S. recycling rates with solutions that are already working in several states," said Sarah Edwards, Director, Eunomia North America. "This report is just one piece of the puzzle. It is crucially important we have consistent and transparent measurement in order to create meaningful change. We want to help policymakers, operators, and investors make more informed strategic decisions when it comes to recycling, infrastructure investment and reducing emissions in waste management."

Among the other highlights in the report:

- Of the top 10 recycling states:

- 7 have good data quality, availability and state reporting systems.

- 8 have a Deposit Return System (DRS) or "bottle bill."

- 8 have higher landfill disposal costs on a per ton basis.

- Low-value cardboard and boxboard makes up 73% of the recycling waste stream.

- Recycling one ton of aluminum has 3x the GHG reduction benefit compared to recycling one ton of cardboard.

- More effective waste management policies could reduce global CO2 emissions by up to 5% – the equivalent of grounding all commercial flights globally and taking 65% of cars off the road for a year.

- 9 of the top 10 states with the highest recycling rates for PET bottles and aluminum cans are states with a DRS and curbside recycling infrastructure.

- 3.5x more PET and 3x more aluminum is recycled in DRS states than in non-DRS states.

- Only 32% of non-bottle PET (such as clamshells) collected is estimated to be recycled across the 50 U.S. states.

"America's recycling system is broken, but the good news is Americans overwhelmingly support some of the most effective solutions to reform it," said Ball Corporation Chairman and CEO John Hayes. "If we are willing to recapitalize our antiquated recycling system by taking a fresh look at the way we create incentives, invest in adequate infrastructure and change behaviors to drive real recycling, we can lead the country toward a more circular and sustainable future."

In coordination with the new report's publication, Ball released findings from a national survey of 4,000 U.S. adults conducted March 6-15, 2021, which shows strong support for policies that would improve recycling and reduce packaging pollution. Among the survey findings:

- 90% agree that "companies should use packaging that can be easily reused or recycled."

- 84% agree that "investing in expanding and improving our nation's recycling infrastructure should be a higher priority."

- 84% agree that "the U.S. should create a nationwide beverage container refund program to encourage recycling, where consumers get back a small fee for returning empty glass jars, aluminum cans and plastic bottles."

- 81% agree that "difficult or impossible to recycle packaging materials should be phased out of use in the U.S. to reduce pollution."

- 67% agree that "companies that manufacture food and beverage containers should be responsible for the cost of collecting and recycling their products after people discard them."

"Understanding the current state of our recycling system is crucial to designing policies, infrastructure and products that support true circularity in our communities," said Keefe Harrison, CEO of The Recycling Partnership. "This report demonstrates that no one thing will heal recycling's challenge alone. The key is addressing the system holistically to drive real and meaningful change."

As lawmakers at both the state and federal level consider legislative and regulatory proposals to improve recycling and reduce packaging pollution, including the recently reintroduced Break Free From Plastic Pollution Act in the U.S. Congress, this national survey and "The 50 States of Recycling" report are instructive as these debates continue. They demonstrate that many of the most effective legislative measures are also popular among the American public.

To view the full report and download fact sheets, visit www.Ball.com/RealCircularity. The full report is also available for download on the Eunomia website.

About Ball Corporation

Ball Corporation supplies innovative, sustainable aluminum packaging solutions for beverage, personal care and household products customers, as well as aerospace and other technologies and services primarily for the U.S. government. Ball Corporation and its subsidiaries employ 21,500 people worldwide and reported 2020 net sales of $11.8 billion. For more information, visit www.ball.com, or connect with us on Facebook or Twitter.

About Eunomia

Established in 2001, Eunomia Research & Consulting ('Eunomia') is an international environmental consultancy dedicated to adding value to organisations through the delivery of improved outcomes. Eunomia has over 100 employees, with offices in Bristol, London, Manchester, Brussels, Athens, New York and Auckland. Working throughout the UK, other EU Member States and beyond, Eunomia's consultants have experience and expertise in environmental, technical and commercial disciplines. For more information about Eunomia, please visit www.eunomia.co.uk.

Forward-Looking Statements

This release contains "forward-looking" statements concerning future events and financial performance. Words such as "expects," "anticipates," "estimates," "believes," "targets," "likely," "positions" and similar expressions typically identify forward-looking statements, which are generally any statements other than statements of historical fact. Such statements are based on current expectations or views of the future and are subject to risks and uncertainties, which could cause actual results or events to differ materially from those expressed or implied. You should therefore not place undue reliance upon any forward-looking statements and any such statements should be read in conjunction with, and, qualified in their entirety by, the cautionary statements referenced below. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Key factors, risks and uncertainties that could cause actual outcomes and results to be different are summarized in filings with the Securities and Exchange Commission, including Exhibit 99 in our Form 10-K, which are available on our website and at www.sec.gov. Additional factors that might affect: a) our packaging segments include product capacity, supply, and demand constraints and fluctuations, including due to virus and disease outbreaks and responses thereto; availability/cost of raw materials, equipment, and logistics; competitive packaging, pricing and substitution; changes in climate and weather; footprint adjustments and other manufacturing changes, including the startup of new facilities and lines; failure to achieve synergies, productivity improvements or cost reductions; unfavorable mandatory deposit or packaging laws; customer and supplier consolidation; power and supply chain interruptions; potential delays and tariffs related to the U.K's departure from the EU; changes in major customer or supplier contracts or a loss of a major customer or supplier; political instability and sanctions; currency controls; changes in foreign exchange or tax rates; and tariffs, trade actions, or other governmental actions, including business restrictions and shelter-in-place orders in any country or jurisdiction affecting goods produced by us or in our supply chain, including imported raw materials; b) our aerospace segment include funding, authorization, availability and returns of government and commercial contracts; and delays, extensions and technical uncertainties affecting segment contracts; c) the Company as a whole include those listed above plus: the extent to which sustainability-related opportunities arise and can be capitalized upon; changes in senior management, succession, and the ability to attract and retain skilled labor; regulatory action or issues including tax, environmental, health and workplace safety, including U.S. FDA and other actions or public concerns affecting products filled in our containers, or chemicals or substances used in raw materials or in the manufacturing process; technological developments and innovations; the ability to manage cyber threats; litigation; strikes; disease; pandemic; labor cost changes; rates of return on assets of the Company's defined benefit retirement plans; pension changes; uncertainties surrounding geopolitical events and governmental policies both in the U.S. and in other countries, including policies, orders and actions related to COVID-19, the U.S. government elections, stimulus package(s), budget, sequestration and debt limit; reduced cash flow; interest rates affecting our debt; and successful or unsuccessful joint ventures, acquisitions and divestitures, and their effects on our operating results and business generally.

SOURCE Ball Corporation